75+ choices for your personal loan in one place

Browse through a curated selection of Australia's top lenders, all in one place.

We provide clear, concise comparisons so you can make an informed choice.

We believe in complete transparency. Our service is free, with no hidden fees or costs.

Life throws you curveballs, and in the event you need funds finding the right one for you can be difficult. Personal loans give you more options. For the couple who are wanting to get married and need some help getting there, to the home renovator who needs to have their kitchen fixed or extra room built, or it could be for a medical emergency.

Personal loans are an easy way to pay for some of life’s big expenses, but how do you know what’s right for you? PersonaLoanOptions.ai gives borrowers transparency on rates, shining the light on hidden fees and gives access to over 60 + lenders. With no footprint on your credit score, being able to compare your lenders allows you to make smarter decisions so you can choose what loan works for your situation. How good is that?

It could be for that well-deserved getaway, or it could also be for a car or getting that deck in the house fixed. No matter what, Loan Options can get you there!

We make it simple for you. There are three easy steps to follow when applying.

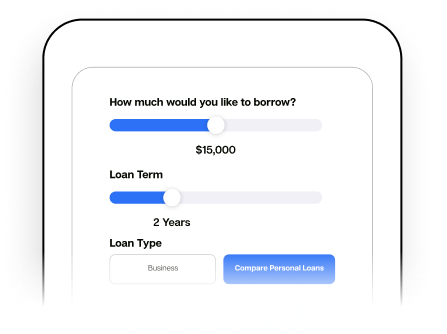

Input your information in our AI options tool and it will calculate and present you with the best options available! Remember, the more information you provide, the more accurate your loan options will be.

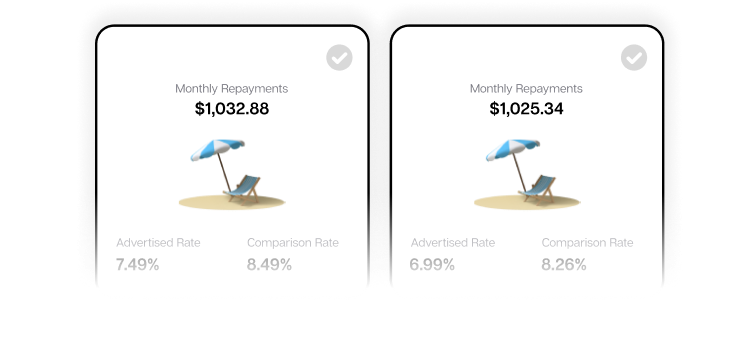

Let our AI options tool do the work instantly! No waiting around! With over 60 Lenders, our AI options tool will curate and personalise the best results based on your priorities.

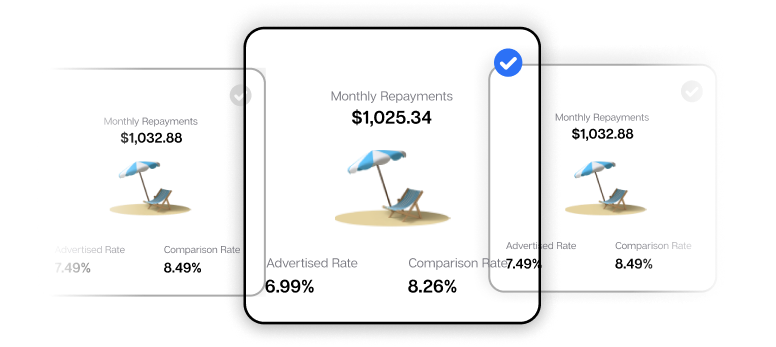

Now the easy part! Pick from the list and if you need further clarity, the platform can provide you with a granular level of detail to help find what you are looking for. For a more personal touch our Customer Service Consultants are available to talk to you.

We have said it before, and we’ll say it again, not every loan is the same! When you are applying for a loan it can be either an unsecured or secured loan.

Finding the right loan can be confusing and to make it easier we’ve defined the below.